21+ Mortgage i can afford

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. You Arent Saving Money.

News Michelle Perez Realtor Re Max Gold

Whether you are unable to contribute to.

. This time last week it was 593. Compare Offers Side by Side with LendingTree. The part of your monthly payment that reduces the outstanding balance of your.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Payments you make for loans or other debt but not living expenses like. Check Your Eligibility and Connect With Our VA Loan Team for a Free Consultation Today.

While you may have heard of using the 2836 rule to calculate affordability the. What Mortgage Can I Afford - If you are looking for lower expenses then our services can help you improve financial situation. For licensing information go to.

Your maximum monthly mortgage payment would. Compare Mortgage Options Calculate Payments. The APR on a 30-year fixed is 599.

Apply Online Get Pre-Approved Today. Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. Thats a 120000 to 150000 mortgage at 60000.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. For Teresa and Martin who can both afford a 20 down payment the monthly payment will be around 800 well. For actual payment rates and term contact 21st Mortgage at 800-955-0021 and speak to one of our loan originators.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Mortgage lenders like to see that you spend no more.

All three of our homebuyers can afford this one. FHA VA Conventional HARP And Jumbo Mortgages Available. Once you have a shortlist of mortgage lenders its time to apply with each of them.

Another sign that you may not be able to afford your mortgage is that you arent saving money each month. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross. Your housing expenses should be 29 or less.

Total income before taxes for you and your household members. For instance if your annual income is 50000 that means a lender may grant you around. Lock Your Mortgage Rate Today.

For many people homeownership is a huge financial achievement. This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI. Your monthly mortgage payment is typically made up of four parts.

For example lets say your pre-tax monthly income is 5000. 2 days agoFill out the pre-approval application. Ad Compare Your Best Mortgage Loans View Rates.

At an interest rate of 598 a 30-year fixed mortgage would cost 598. How much mortgage can i qualify calculator mortgage. Depending on where you live even a small starter house or condo can cost you hundreds of thousands of dollars.

When you apply for a mortgage many lenders use the 2836 rule to ensure you can afford the loan and its monthly payments. Your debt-to-income ratio DTI should be 36 or less. The average American family can no longer afford to purchase a median-priced home when mortgage rates go above 57 says Nadia Evangelou senior economist with the.

But our chase home. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. How much house can I afford if I make 3000 a month.

Heres what youll usually need to provide on the. How Much House Can I Afford. Generally lend between 3 to 45 times an individuals annual income.

Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best. This ratio says that. Mortgage lenders in the UK.

The 30-year jumbo mortgage rate had a 52-week low of. Apply Now With Quicken Loans. Compare Mortgage Options Calculate Payments.

Ad Compare Best Mortgage Lenders 2022. This is for things. Ad See Todays Rate Get The Best Rate In A 90 Day Period.

Get the Right Housing Loan for Your Needs. Ad Get Personal Attention and Support From a Leader in Government-Backed Mortgage Lending. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643.

Lock Your Mortgage Rate Today. Payment estimate is for a loan to purchase a primary residence. Ad Were Americas Largest Mortgage Lender.

Your mortgage payment should be 28 or less. Apply Now With Quicken Loans. Ad Get Trusted Insights From Fidelity Investments During Your Home Buying Journey.

If you make 3000 a month 36000 a year your DTI with an FHA loan should be no more than 1290 3000 x 043. You can find this by multiplying your income by 28 then dividing that by 100. The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week.

Ad Were Americas Largest Mortgage Lender. APR is the all-in cost of your loan. 21st Mortgage Corporation 620 Market Street Knoxville TN 37902 865 523-2120.

Save Time Money. Provide details to calculate your affordability.

When People Born In The 50s And 60s Say How They Don T Have Student Loan Debts And Why It Is So Bad Here Is A Good Chart R Damnthatsinteresting

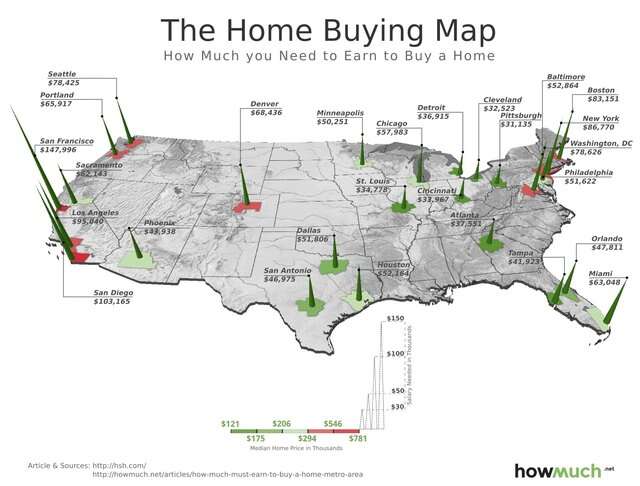

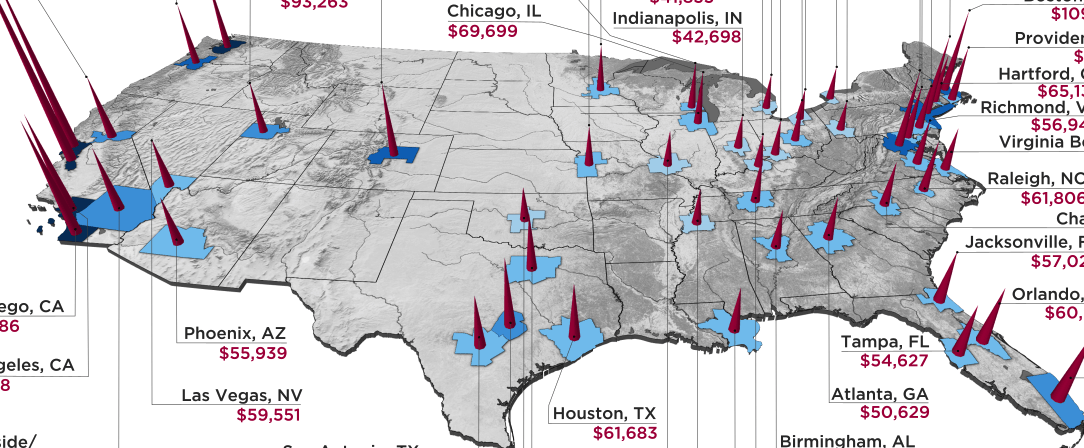

Income Needed To Buy A House Can You Afford One Spendmenot

Term Life Insurance What You Need To Know Before You Buy Here S A Comprehensive Guide To Help You Purchase The Ri Term Life Term Life Insurance Life Insurance

Handover Certificate Template 13 Templates Example Templates Example Certificate Templates Blank Certificate Template Free Certificate Templates

How Much It Costs To Own A Home In America Thrillist

2

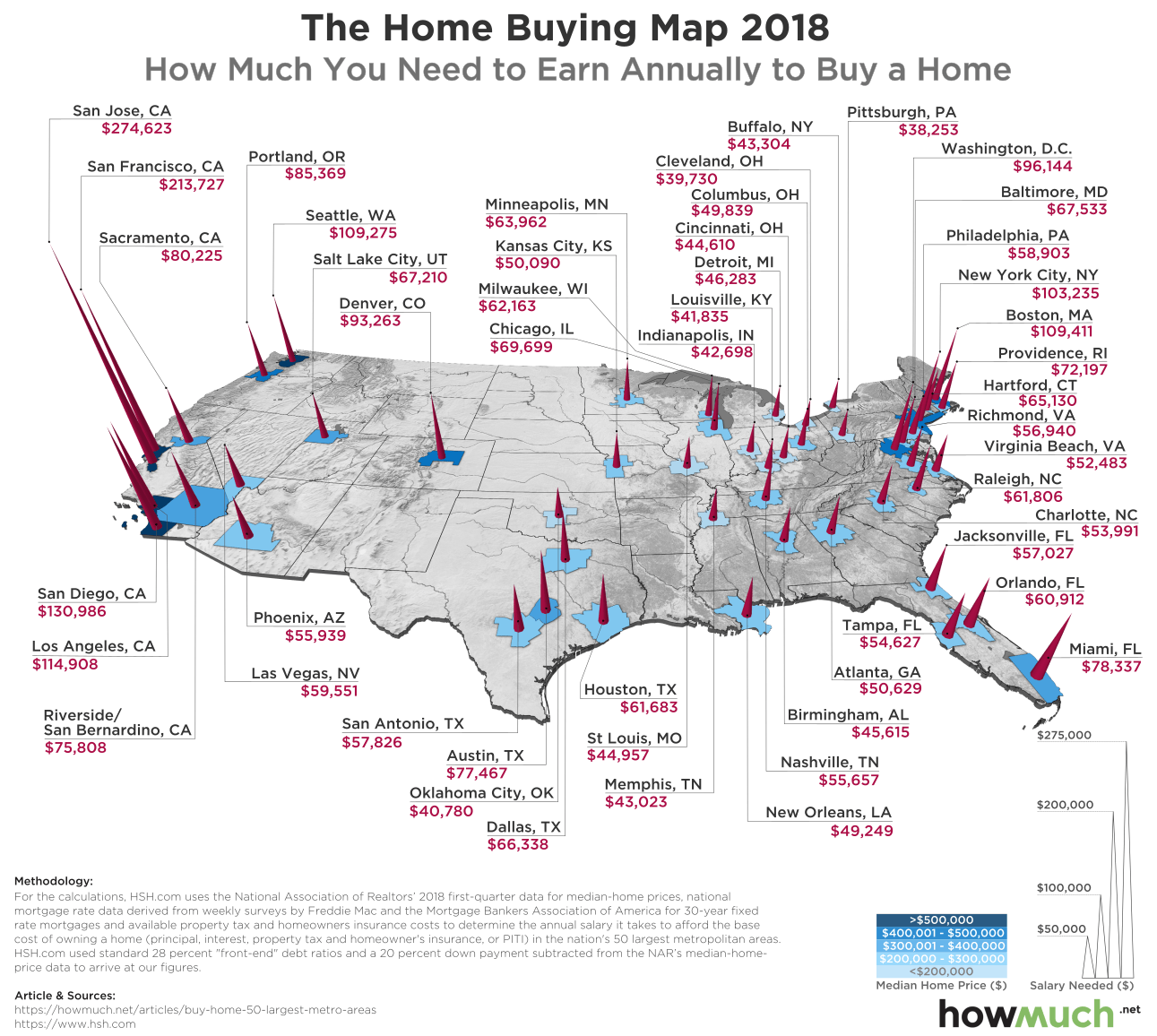

How Much You Need To Earn To Buy A Home In Major Us Cities Mapped Thrillist

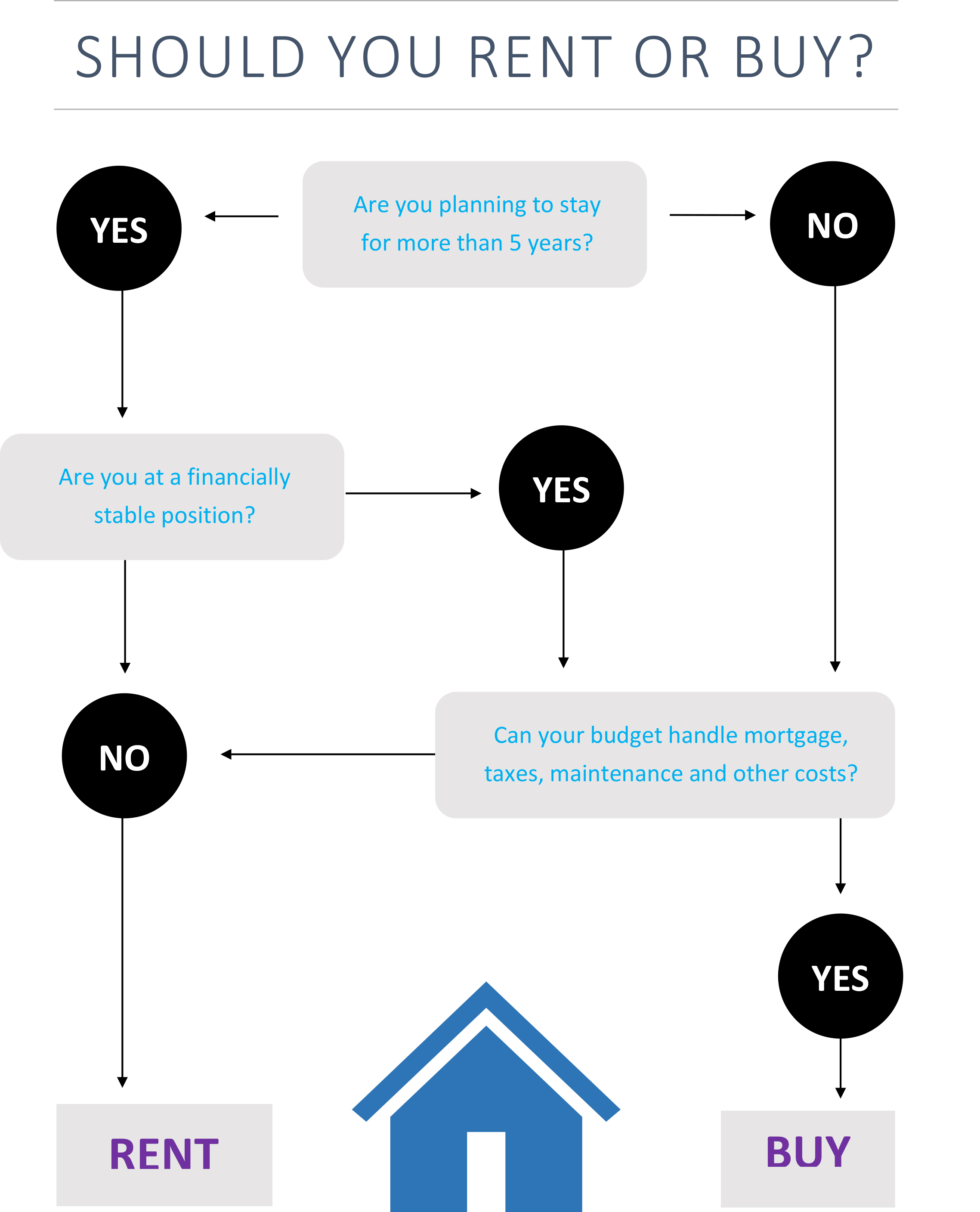

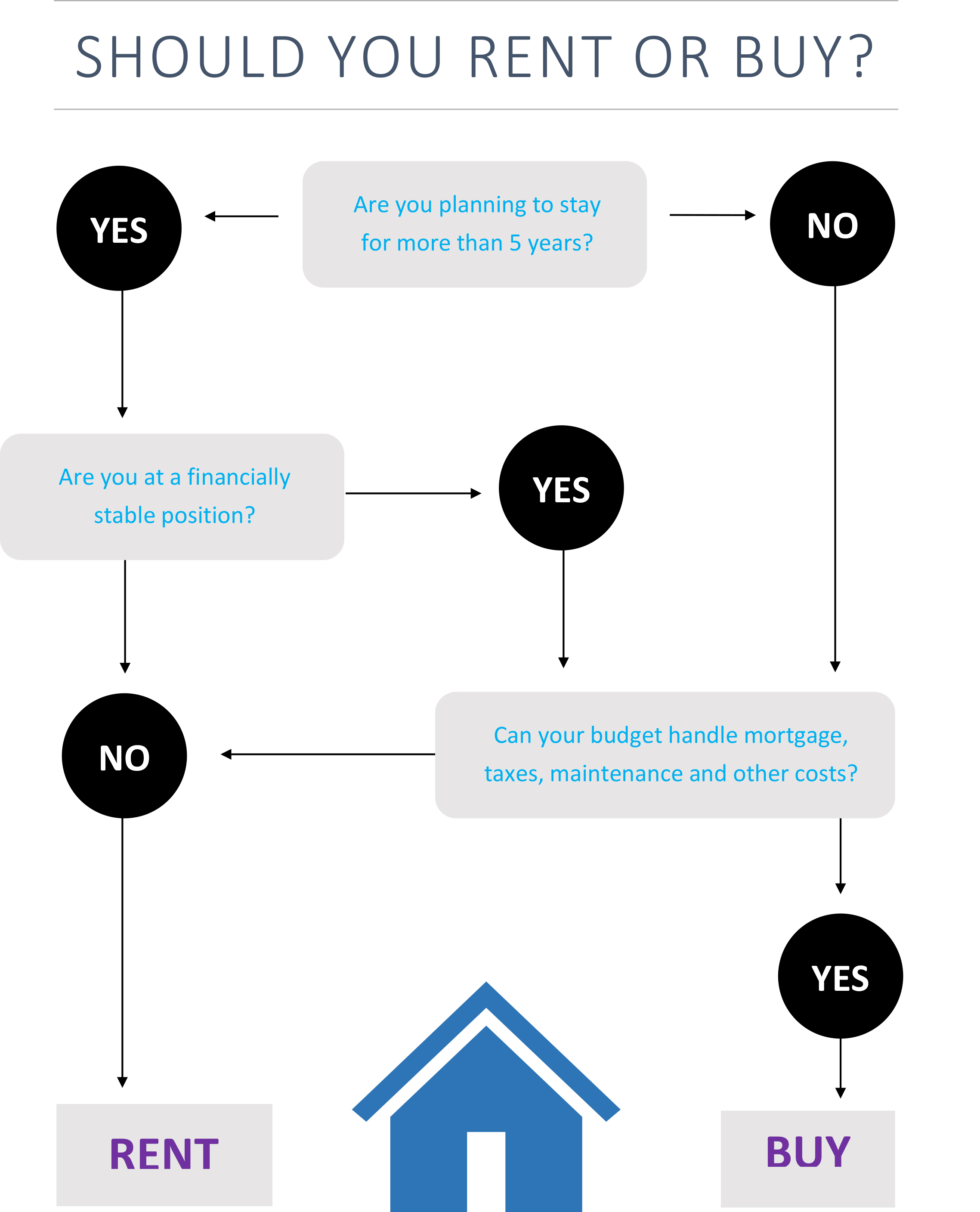

How To Make A Flowchart In Word 20 Flowchart Templates

Decoomo Trends Home Decor Chambre Princesse Deco Chambre Parents Chambres De Reve

How Does A Credit Card Billing Cycle Work

Pin On Home Ownership Tips

How Much You Need To Earn To Buy A Home In Major Us Cities Mapped Thrillist

If I Pay My Credit Card Early Can I Use It Again

News Michelle Perez Realtor Re Max Gold

Term Life Insurance What You Need To Know Before You Buy Here S A Comprehensive Guide To Help You Purchase The Ri Term Life Term Life Insurance Life Insurance

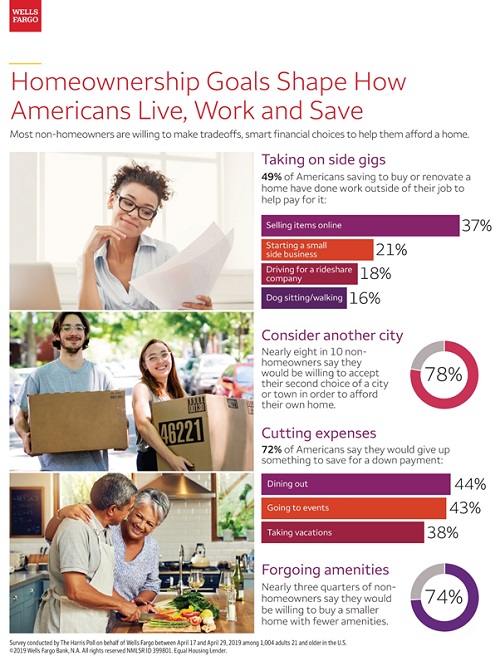

Potential Homeowners Will Work Two Jobs To Save Down Payment Mortgage Professional

Income Needed To Buy A House Can You Afford One Spendmenot